Invoice Management Software for Faster Payments in 2025: Now Powered by AI

Getting paid should be easy, but in 2025, sending invoices remains a big hassle for agencies, small enterprises, and freelancers. Every month, professionals squander hours on mundane chores like manually preparing invoices and following up on late payments. In fact, data indicates that about 43 percent of invoices are paid beyond the due date, and freelancers lose weeks yearly chasing past-due bills.

The good news? These problems are removed by modern invoice management software, which handles invoicing, tracks payments, and sends reminders. This allows you to spend more time expanding your business and less time chasing money. We’ll look at what these tools perform, why they’re important in 2025, and how to pick the best one for your requirements in this article.

Table of Contents

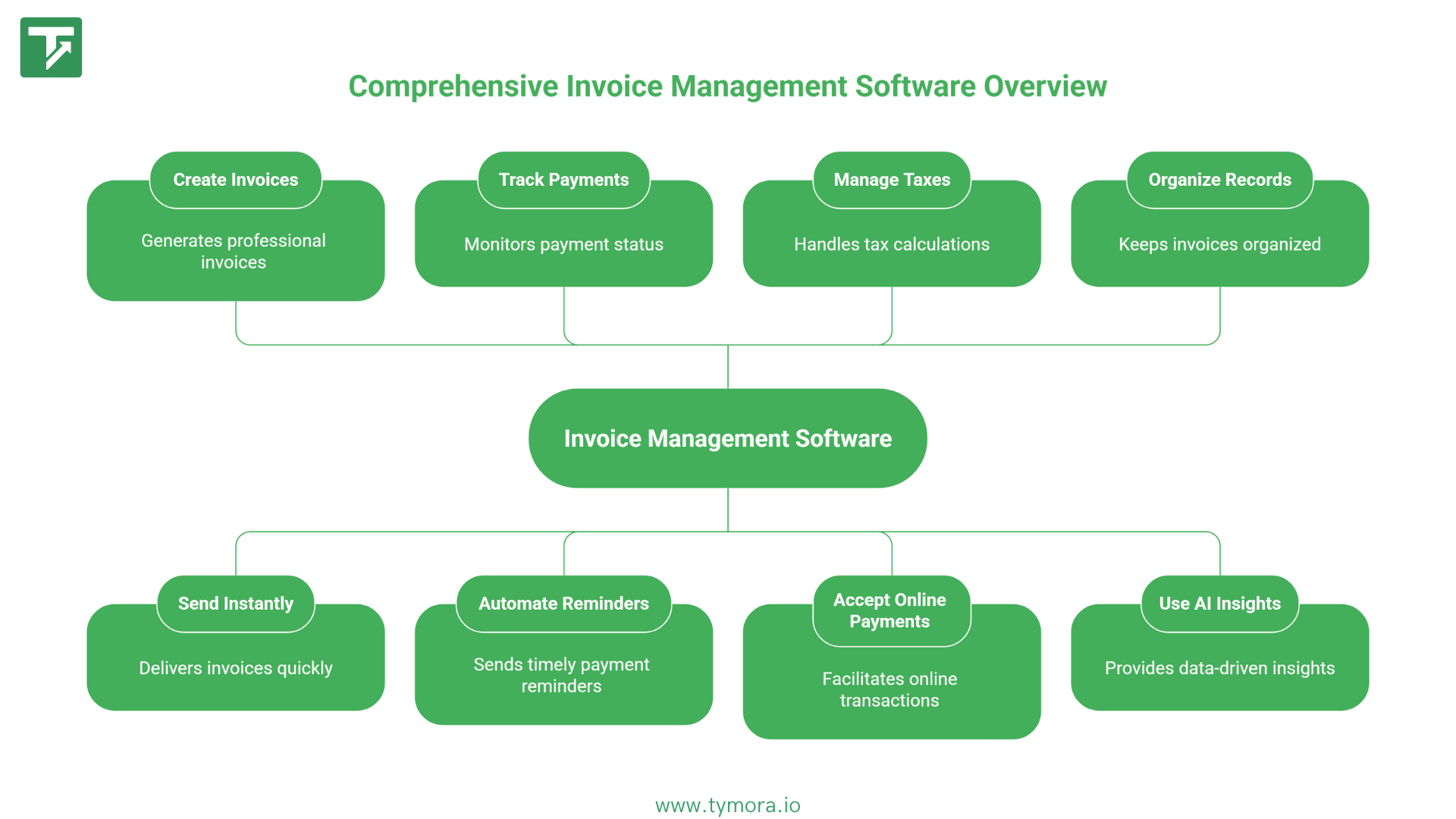

What Invoice Management Software Actually Does?

If you’ve ever heard someone pitch invoice software, you’ve probably come across phrases like “streamline your workflow” or “make billing effortless.” Sounds nice, but what does that actually mean in practice?

Let’s strip away the buzzwords. Invoice management software is basically your digital billing assistant. This tool automates the boring, error-prone, and time-consuming parts of invoicing, helping you get paid faster, stay compliant, and look more professional.

Let’s dissect the fundamental operations in detail below, providing examples and clear explanations.

1. Create Professional Invoices

Back in the day, many freelancers and businesses would:

- Open a Word or Excel template.

- Manually enter client name, service description, and totals.

- Double-check tax calculations with a calculator.

- Export to PDF, attach to an email, and hope it looked okay.

That’s a lot of steps. And it leaves room for mistakes wrong client name, miscalculated totals, or inconsistent formatting.

With invoice software:

- You select a pre-designed, branded template.

- Add your logo, colors, and even custom fields once.

- Next time, you just pick a client, enter items, and the system does the math (taxes, discounts, totals).

Example: A freelance designer can create an invoice in under 2 minutes with tools like Tymora, compared to 15–20 minutes with manual templates.

2. Send Invoices Instantly

Emailing invoices manually creates bottlenecks. Attachments sometimes get lost, or worse, end up in spam folders.

Invoice software fixes this by:

- Sending invoices directly through the platform with one click.

- Delivering professional-looking emails (no messy attachments).

- Allowing clients to open invoices through a secure link.

Some platforms even let you send invoices via SMS or WhatsApp in regions like India, where messaging apps are often the fastest way to get client attention.

3. Track Payments

One of the biggest frustrations for freelancers and small businesses is simply not knowing what’s happening with an invoice once it’s sent. Did the client open it? Did they forget? Is it sitting in spam?

Invoice management software gives you visibility:

- See when a client opens your invoice (like an email “read receipt”).

- Track payments in real-time whether it’s pending, overdue, or cleared.

- Filter by client to see who consistently pays late.

Example: Instead of searching through emails, you can log in and immediately see: “Invoice #1032 → Opened, due in 5 days.” No guesswork.

4. Automate Reminders

Nobody likes chasing payments. Sending that “Just checking in…” email feels awkward and wastes time.

With invoice software, reminders are automated and professional:

- Set rules like: “Send a gentle reminder 3 days before due date.”

- Add escalating reminders: polite first, firm second, late fee notice third.

- Customize the tone to match your brand.

Example: Instead of writing three different follow-up emails for three different clients, the system sends them automatically while you focus on actual work.

5. Manage Taxes & Compliance

Tax season is often where the real chaos begins. Missing invoices, mismatched amounts, or confusion about GST/VAT rates can quickly turn into penalties.

Invoice tools handle this by:

- Automatically applying the right tax rate (GST in India, VAT in Europe, sales tax in the U.S.).

- Generating tax-compliant invoice formats (like GST e-invoices in India).

- Keeping digital records that you can export for your accountant in seconds.

6. Accept Payments Online

The easier you make it for clients to pay, the faster you’ll get paid. Invoice management software integrates directly with payment gateways:

- Stripe, PayPal, and Wise for international payments.

- UPI, Razorpay, and Paytm for India.

- Direct ACH/bank transfers in the U.S.

That means your client doesn’t have to “log in to their bank later” they just click Pay Now.

Example: A U.S. client receives an invoice with a “Pay via PayPal” button. Instead of waiting days for a wire transfer, the payment clears instantly.

7. Keep Records Organized

Manual invoicing means hunting through folders for PDFs when your accountant asks for quarterly reports.

With software:

- Every invoice, receipt, and payment is stored digitally.

- You can filter by client, date, or payment status.

- Many platforms integrate with accounting tools like QuickBooks or Xero, eliminating double data entry.

8. AI-Powered Extras

In 2025, AI isn’t just a buzzword it’s actually saving time. Some invoice tools now:

- Auto-generate invoices from project milestones or contracts.

- Suggest payment terms based on client history.

- Flag invoices likely to be delayed so you can follow up proactively.

Example: Tymora predicts that a client who delayed 3 out of 5 past invoices will likely delay again, so it auto-schedules earlier reminders.

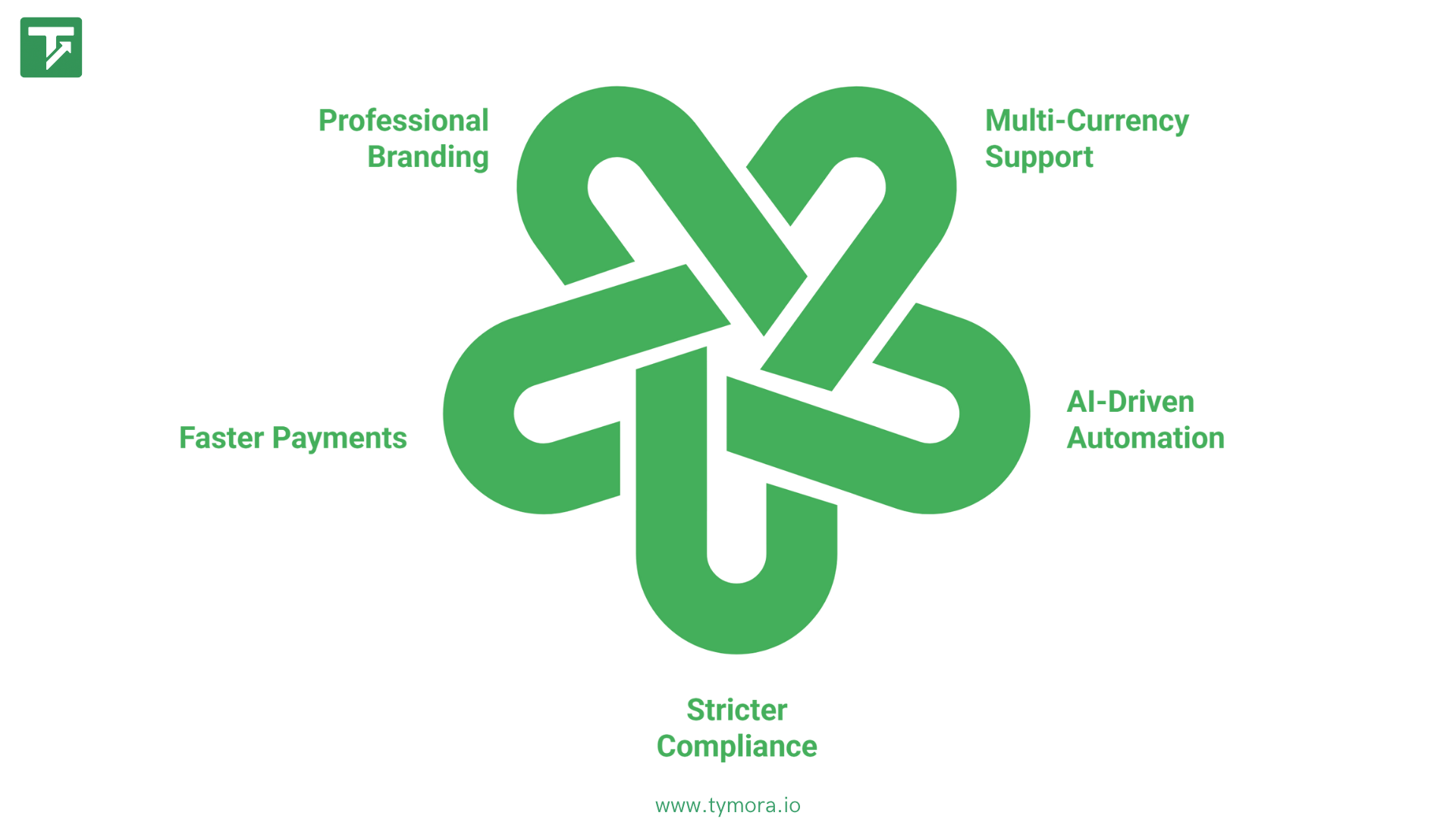

Why Invoice Management Software Matters in 2025?

Invoicing has always been about getting paid but in 2025, it’s also about keeping up with changing business realities. Remote work, global clients, AI, and stricter compliance rules have transformed what “good invoicing” looks like. Here’s why software has become essential.

1. Cross-Border Clients Need Multi-Currency Support

Freelancers and agencies increasingly work with clients worldwide. A developer in India might bill U.S. clients in USD, a UK client in GBP, and still need GST-compliant invoices locally.

With software: You can invoice in multiple currencies, apply the right taxes, and integrate payment gateways that handle conversions automatically.

Example: Instead of recalculating rates manually, a freelancer in Delhi can send a USD invoice to a U.S. client and an INR invoice to a local one all from the same dashboard.

2. AI Is Making Invoicing Smarter

Today’s tools don’t just store data they use AI to save time and predict problems.

- Auto-generate invoices from contracts or milestones.

- Schedule reminders based on client behavior.

- Suggest better payment terms for chronic late payers.

Example: An agency finishes a project milestone, and the system instantly drafts an invoice without anyone typing a line.

3. Compliance Rules Are Tougher

Governments now expect digital records, not messy PDFs.

- India requires GST e-invoicing for many businesses.

- EU countries are phasing in mandatory VAT e-invoicing.

- The U.S. IRS is pushing stricter small-business reporting.

With software: Invoices are tax-compliant, stored digitally, and exportable in seconds for accountants.

4. Faster Payments Are the New Normal

Clients want to pay as quickly as they order online.

- In India, UPI dominates with billions of transactions monthly.

- Globally, Stripe, PayPal, and Wise are preferred.

With inovice software: You can add a Pay Now button to invoices so clients pay instantly.

5. Clients Expect Professionalism

Invoices aren’t just bills they represent your brand. Clean, branded invoices with multiple payment options inspire trust and speed up payments.

Example: Compare a plain Excel sheet with no logo vs. a sleek invoice with your branding and payment link. Which one feels more credible?

Key Features to Look For in Invoice Management Software?

Not all invoice tools are created equal. Some cover just the basics, while others act like a full finance hub. Here’s a clear, practical breakdown of what to look for in 2025:

| Feature Type | Feature | What It Does | Example |

|---|---|---|---|

| Must-Have | Recurring Invoices | Automatically sends monthly or subscription invoices. | Monthly retainer invoice auto-sent to client. |

| Must-Have | Payment Tracking Dashboard | Shows paid, pending, and overdue invoices in one place. | Dashboard displays all client payments instantly. |

| Must-Have | Late Fee Automation | Automatically adds fees to overdue invoices. | 2% late fee applied after 7 days overdue. |

| Must-Have | Multi-Currency & Tax Compliance | Supports international currencies and tax rules (GST, VAT, etc.). | Invoice in USD for US client, INR with GST for local client. |

| Nice-to-Have | AI-Powered Proposals & Invoices | Converts approved proposals directly into invoices. | Approved quote becomes an invoice automatically. |

| Nice-to-Have | P&L Dashboards & Analytics | Tracks revenue, expenses, and forecasts cash flow. | Shows percentage of revenue from recurring clients. |

| Nice-to-Have | Client Portals | Allows clients to view, pay, and download invoices. | Clients access past invoices without emailing you. |

| Nice-to-Have | Integrations with Other Tools | Syncs with accounting, CRM, or project management apps. | Task completion in Trello triggers invoice creation. |

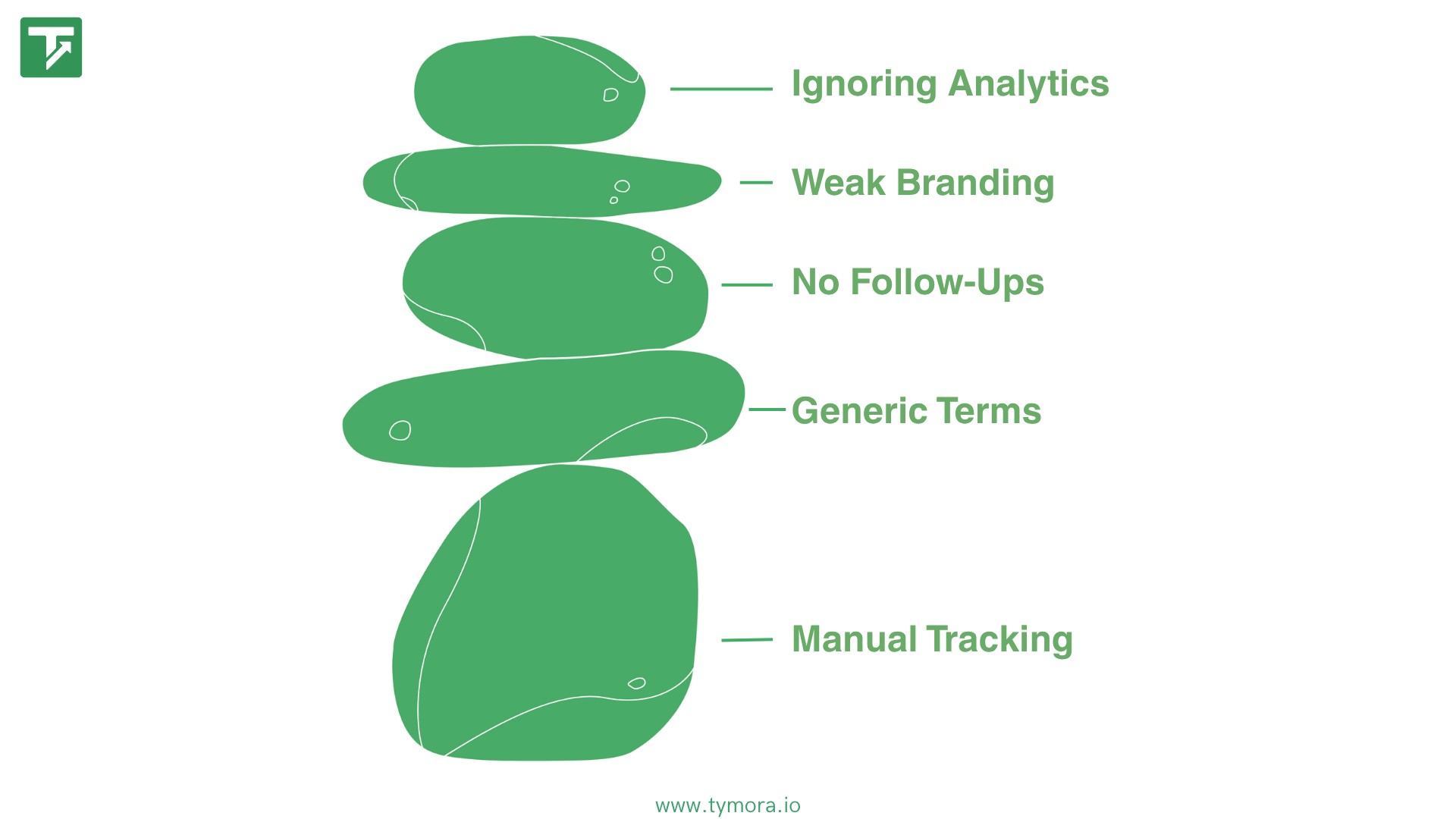

Common Mistakes Businesses Make With Invoicing

Even with modern software, many freelancers and small businesses still fall into the same traps. Avoiding these mistakes can save time, improve cash flow, and make your business look more professional.

1. Relying on Spreadsheets or Manual Tracking

Manually tracking invoices in Excel or Word is prone to errors. Missing entries, miscalculations, or lost files lead to delayed payments and frustration.

Tip: Move to software that tracks invoices automatically and provides a dashboard view.

2. Not Customizing Payment Terms

Using generic terms like “Net 30” may not work for all clients. Some clients prefer upfront partial payments, while others need shorter or longer windows.

Tip: Set clear, client-specific payment terms from the start to avoid confusion.

3. Forgetting to Follow Up on Overdue Invoices

Many businesses wait too long or rely on memory to chase late payments. This creates unnecessary delays and impacts cash flow.

Tip: Schedule automated reminders and review overdue invoices weekly.

4. Poor Branding or Unprofessional Invoices

An invoice is part of your business identity. Messy, unbranded invoices may make clients question your professionalism and delay payments.

Tip: Use branded templates with clear formatting and payment instructions.

5. Ignoring Analytics and Cash Flow Insights

Not tracking which clients pay late or which projects are profitable leads to missed opportunities and financial surprises.

Tip: Use reporting features in your software to monitor trends and plan ahead.

A Step-by-Step Guide to Making Your Invoicing Process More Efficient

Efficient invoicing is more than just mailing bills; it’s about developing a system that saves time, increases cash flow, and decreases stress. Here’s a simple step-by-step approach:

1. Standardize Your Templates

Use professional, branded templates for all invoices. Include your logo, contact info, itemized services, taxes, and payment instructions.

Example: A freelance designer uses the same template for every client, so creating an invoice takes under 2 minutes.

2. Automate Recurring Work

Set up recurring invoices for retainer clients or subscription services. Automation ensures no invoice is forgotten and reduces manual effort.

Example: A marketing agency automatically bills clients on the 1st of every month for ongoing services.

3. Set Clear Payment Terms From Day One

Define due dates, accepted payment methods, and late fees upfront. Communicate them in your contract and on the invoice.

Example: “Payment due in 15 days. Late fee of 2% applies after 5 days overdue.”

4. Track Overdue Invoices Weekly

Review outstanding invoices at least once a week. Follow up promptly either manually or with automated reminders.

Example: Every Friday, an agency checks its dashboard and sends reminders for any invoices overdue by 3+ days.

5. Use Analytics to Forecast Cash Flow

Leverage software reports to monitor trends like recurring late payers, revenue patterns, and client profitability.

Example: A consultant identifies which clients consistently pay late and adjusts future payment terms accordingly.

6. Offer Multiple Payment Options

The easier it is for clients to pay, the faster you get paid. Include UPI, PayPal, Stripe, or direct bank transfer options.

Example: Clients can pay immediately via a “Pay Now” button in the invoice, reducing delays.

7. Automate Follow-Ups

Set reminders for approaching and overdue payments. Automation removes the awkwardness of chasing clients manually.

Example: The system sends a polite reminder 3 days before the due date and a firm reminder 5 days after.

8. Keep All Records in One Place

Store invoices, receipts, and tax-related documents digitally. This helps with audits, tax filing, and historical reference.

Example: During GST filing, a business exports all invoices from the software instead of searching through folders.

Tools Worth Considering in 2025

| Tool | Features | Pros | Cons |

|---|---|---|---|

| FreshBooks | Recurring invoices, payment tracking, time tracking, payment integrations. Focused on ease of use and basic invoicing. | User-friendly, good for freelancers and small businesses. | Can get expensive as client base grows, limited advanced analytics. |

| Zoho Invoice | Multi-currency support, automated reminders, client portal, tax compliance (GST/VAT). Strong in international billing and compliance. | Handles global clients well, automation of reminders. | Some advanced features require paid Zoho plans, interface can feel cluttered. |

| QuickBooks Online | Automated invoicing, advanced accounting, multi-currency support, tax reporting, integrations. Best for SMBs needing full accounting. | Powerful accounting and reporting features. | Higher pricing, steeper learning curve, complex for freelancers. |

| Tymora | AI-generated invoices, predictive payment reminders, analytics dashboards, multi-currency support, automated workflows all in one affordable platform. Offers more automation and insights than the others at a lower cost. | Combines AI, automation, analytics, and affordability; ideal for freelancers, agencies, and small businesses. | Newer platform, fewer third-party integrations. |

Pro Tips for Getting Paid Faster

Getting paid quickly isn’t just about sending invoices it’s about making it easy for clients and staying on top of follow-ups. Here are some practical tips:

1. Offer Multiple Payment Options

Provide UPI, PayPal, Stripe, or bank transfer. The easier it is for clients to pay, the faster you get funds.

Tip: Tymora integrates multiple payment methods directly into invoices, reducing delays.

2. Send Invoices Immediately After Work

Don’t wait until the end of the month. Send invoices as soon as milestones or projects are completed.

Tip: With Tymora, you can quickly generate invoices from project data, saving time and keeping payments on schedule.

3. Use Polite, Automated Reminders

Follow up without awkwardness. Set reminders before and after due dates to keep clients on track.

Tip: Tymora’s AI-driven reminders adapt based on client payment habits, ensuring timely nudges without manual effort.

4. Incentivize Early Payments and Discourage Late Ones

Offer small discounts for early payments or apply late fees when terms are exceeded.

Tip: Tymora automates late fee application and early payment incentives, so you don’t have to track it manually.

5. Keep Your Invoices Clear and Professional

Clarity builds trust. Include itemized services, due dates, and payment instructions.

Tip: Tymora’s templates ensure your invoices are clean, branded, and easy for clients to understand.

Closing Thought

Invoicing isn’t just admin it’s a growth tool. Efficient invoicing saves time, reduces late payments, and builds client trust.

- Choose the Right Tool: Use software that automates tasks, tracks payments, and provides insights. Tymora combines AI automation, multi-currency support, analytics, and affordability in one platform.

- Test and Track: Try a tool for a month to see how much time and effort you save.

- Systemize Invoicing: Standardize templates, automate recurring work, follow up consistently, and leverage analytics.

- Prioritize Clarity and Professionalism: Clear, branded invoices with multiple payment options speed up payments and enhance credibility.

Tymora has all of the features that make for outstanding invoicing management software, including as automation, AI-driven reminders, analytics, multi-currency support, and professional templates, to help you save time, get paid faster, and stay organized. Begin your free trial today and experience faster invoicing.

FAQS

1. What is the main benefit of using invoice management software?

It automates billing, payment tracking, tax management, and reminders, so saving time, minimizing errors, and increasing cash flow.

2. Can invoice software handle international clients and currencies?

Yes. Most modern tools support multi-currency billing and comply with international tax rules like GST or VAT.

3. How does AI help in invoicing?

AI can auto-generate invoices from approved proposals, predict late payments, and send smart reminders, reducing manual follow-ups.

What's inside?

Categories

Customer Success Stories

See how agencies and freelancers are transforming their businesses with Tymora

Tymora has completely transformed how I manage my freelance business. From invoicing to tracking expenses, everything is streamlined and effortless.

Monowar Iqbal Layek

Freelancer

Managing my freelance work is so much easier with Tymora. Invoicing is fast, expense tracking is simple, and I feel more organized than ever.

Sandeep Acharya

Freelancer

Tymora made managing my freelance projects and finances seamless. The platform is intuitive, and support is always responsive and helpful.

Samsur Rahaman

Automation Framework Architect