Smart Ways to Track Client Payments and Avoid Outstanding Invoices

Ever refreshed your inbox hoping for that “Payment received” notification?

Yeah, we’ve all been there. You finish a project, send the invoice, and then… silence.

If you’re a freelancer, small business owner, or agency, learning how to track client payments properly could be the difference between stress and stability.

You don’t need to juggle spreadsheets or chase clients endlessly. You just need the right system to manage your outstanding invoices, smartly and calmly.

Let’s break it down.

Why You Must Track Client Payments?

Here’s the deal, if you can’t track client payments accurately, you can’t run your business confidently.

When your payments are scattered across emails and chats, problems pile up fast:

- You forget who still owes you money.

- You can’t plan your cash flow.

- You waste time chasing overdue invoices.

- You start to lose trust in your own process.

But when you do track them consistently? You feel clear, organized, and financially in control.

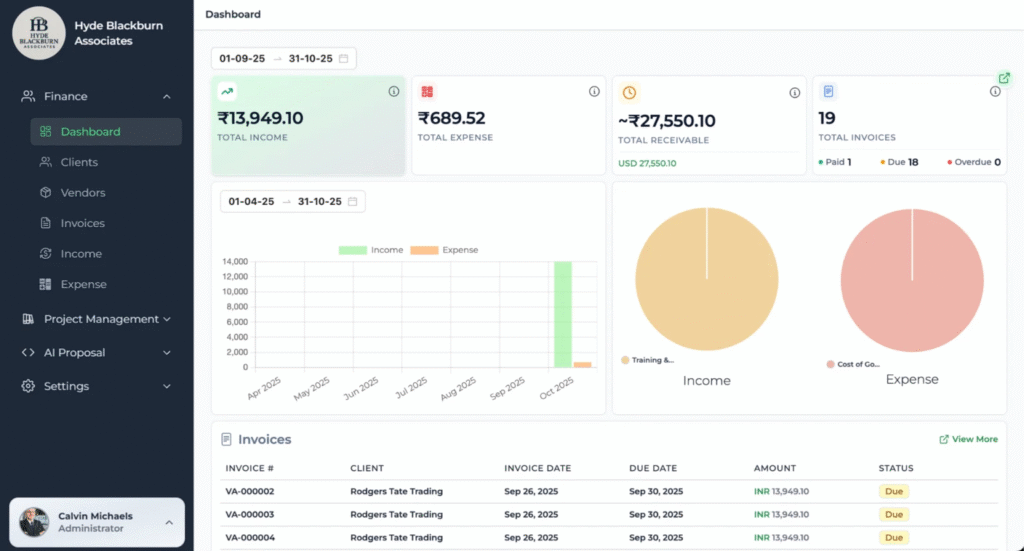

That’s where tools like Tymora come in; helping freelancers and small agencies see every payment, every project, and every invoice in one clean dashboard.

Step 1: Build a Solid System to Track Client Payments

Forget messy notebooks or last-minute reminders. You need one reliable place to track client payments and check all your outstanding invoices at a glance.

Your tracker should include:

- Client name

- Project description

- Invoice number and date

- Due date

- Payment status (Paid / Pending / Overdue)

Start simple if you must, even a sheet helps. But if you want zero manual effort, Tymora can do this automatically. It organizes your invoices, tracks payments, and keeps everything updated, so you never miss a thing.

Step 2: Automate Invoicing and Payment Reminders

Manually sending invoices is fine until your client list grows, then it becomes chaos.

Automating this process saves hours every week. With the right tool, you can:

- Generate invoices in seconds

- Auto-send payment reminders

- Get notified when a client pays

- Track overdue or outstanding invoices instantly

Tymora makes it easy to track client payments without spreadsheets or guesswork. It syncs your projects, records every transaction, and even follows up politely when payments are late.

It’s like having a personal billing assistant on your side 24/7.

Step 3: Set Clear Payment Terms from Day One

Want to avoid awkward “Hey, just checking on payment…” messages? Then be crystal clear about your terms.

When you send an invoice, always mention:

- The exact due date

- Late payment penalties (if any)

- Accepted payment modes

Clear communication makes it easier to track client payments later, because you’ve already set expectations.

Pro tip: add a gentle nudge like “Thank you for prompt payment” it subtly encourages on-time payments and reduces outstanding invoices.

Step 4: Follow Up Like a Pro

Let’s be honest, no one enjoys sending payment reminders. But it’s part of running a healthy business.

Keep your follow-ups friendly, short, and confident. For example:

“Hi [Client Name], just checking in on invoice #203 — it was due yesterday. Kindly confirm if it’s been processed. Thanks!”

That’s it. No guilt. No awkwardness.

Even better? Let Tymora do it for you. It automatically reminds clients about pending payments and marks outstanding invoices once they’re overdue, saving you time (and mental energy).

Step 5: Review Your Payments Regularly

Set a weekly date to check your finances. Open your tracker or Tymora dashboard and review:

- Which clients have paid

- Which payments are pending

- How many outstanding invoices are aging

This habit keeps your business healthy. You’ll instantly spot delays, follow up faster, and stay in control of your cash flow.

Because when you consistently track client payments, you stop guessing, and start managing like a pro.

Why Late Payments Hurt More Than Finances?

It’s not just about money. It’s about respect and security.

When clients delay payments, it’s hard not to take it personally. You feel undervalued, frustrated, and uncertain.

But when you’ve got a clear system to track client payments and manage outstanding invoices, you replace chaos with confidence. You know what’s due, what’s done, and what needs your attention, all in one glance.

That mental clarity? Priceless.

Why Tymora Is Every Freelancer’s Secret Weapon?

If you’re serious about staying organized and stress-free, Tymora is the simplest way to do it.

Here’s what it does for you:

- Tracks client payments automatically

- Flags overdue and outstanding invoices instantly

- Sends follow-ups on autopilot

- Gives you real-time insights into your earnings

It’s not just software, it’s your financial sidekick.

Because when your payments are handled smoothly, your focus shifts back to what you love: your craft, your clients, your growth.

Final Thoughts

Money tracking doesn’t have to be scary.

You don’t need an accountant, you just need the right system to track client payments and handle outstanding invoices without breaking a sweat.

- Stay on top of your payments.

- Say goodbye to messy follow-ups.

- Grow your business with confidence.

It’s time to take charge of your financial flow

Try Tymora today and see how effortless payment tracking can feel.

1. How can I track client payment easily?

You can track client payments using a centralized system that records invoices, due dates, and payment status. Automating the process helps avoid missed or delayed payments.

2. What is the best way to track client payment and outstanding invoices?

The best way is to use a dedicated payment tracking tool or app that shows all paid, pending, and overdue invoices in one place — keeping your finances organized.

3. Why is it important to track client payments regularly?

Tracking client payment regularly ensures steady cash flow, prevents overdue invoices, and helps you follow up on unpaid amounts before they affect your business.

4. How do freelancers track client payment efficiently?

Freelancers can track client payment efficiently by using automated invoicing tools that send payment reminders and display all outstanding invoices clearly.

Categories

Customer Success Stories

Tymora has completely transformed how I manage my freelance business. From invoicing to tracking expenses, everything is streamlined and effortless.

Monowar Iqbal Layek

Freelancer

Managing my freelance work is so much easier with Tymora. Invoicing is fast, expense tracking is simple, and I feel more organized than ever.

Sandeep Acharya

Freelancer

Tymora made managing my freelance projects and finances seamless. The platform is intuitive, and support is always responsive and helpful.

Samsur Rahaman

Automation Framework Architect